Defis – Meaning, Benefits, Risks, Applications, Ways of making money

- How Blockchain can disrupt traditional finance sector ?

- Meaning of Decentralized Finance

- Why Defis are needed?

- Benefits of Defis

- Risks involved in Defis :

Ø Technology risks

Ø Product risks

Ø Collateral risks

Ø Regulatory risks

- Applications/Uses of Defis

- Ways of earning money from Defis

How Blockchain can disrupt traditional finance sector ?

When transactions of traditional finance world are conducted on public blockchain where there is no central agency through which transactions move, such a system will be known as decentralized finance i.e. Defi. Self executing instructions are written in form of codes i.e. smart contracts on a public blockchain which makes it possible for buyers, sellers, lenders, and borrowers to interact peer to peer or with a strictly software-based middleman rather than a company or institution facilitating a transaction.

DeFi : Decentralized Finance

During the early stages of crypto development, there used to be Bitcoin only. Then general perception about crypto was that crypto does nothing, it’s a place of gamblers.

Even I remember about myself when during 2012, I was in a book fair at Pragati Maidan in Delhi to buy some books. I saw a book ‘Bitcoin – Profit Making Strategies’, but i did not buy even though I am addictive to books. The reason of not buying was that Bitcoin is for gamblers.

But now, with the development of DeFis – people stopped saying such things.

What is Decentralized Finance?

Basically, it’s system of finance where various players from finance world participates. Such players may be like banks(lenders/borrowers), pooled entities, providers of financial instruments/negotiable instruments, entire space connected to finance companies, etc.

As on date the entire finance world is associated with the centralized agencies in various ways of one or another like licensing system etc.

Let’s assume, if the entire finance world comes on decentralized platform where there is no boss/controlling central authority like in case of bitcoin, then this finance world will become DeFi (Decentralized Finance).

DeFi is Technology :

It’s a huge accomplishment stage where we are moving towards removing central authority from the finance system in various ways. This achievement is getting possible with the help of technology which I would better say marvel technology i.e. Blockchain technology.

DeFi is a technology. Underlying architecture to DeFi is blockchain technology. We need to have token to power DeFi . We need to have layers in blockchain where blocks are written, multiple ledgers are required in distributed form, etc. All these things in altogether make DeFi as technology.

It’s a system of financial products written on blockchains enabling buyers, sellers, lenders, and borrowers to interact.

DeFi is a Movement. Why DeFi is a movement?

If we talk about traditional finance system, then already we have banks like HDFC, ICICI, SBI, JP Morgan, Bank of America etc. and other financial institutions at micro/macro level both. Now the question is if already we have settled & approved finance system in place, then why we need DeFis?

Whenever new innovation comes in place, that is for something better so that existing work can be done in an improved & better way. DeFi is an alternate to the existing traditional finance system for betterment. Like in the past, lot of other movements were there in the world like privatisation, policy of less govt. interference etc. Same way DeFi is a movement in the space of finance world.

I will use two words – Disintermediation and Decentralization.

Disintermediation :

There is no middleman in the DeFi. Finance provider and user is connected with each other without any intermediary but with technology of blockchain.

Decentralization :

Removal of central authority from the finance system is decentralization.

This is something like we remove the C.E.O. of a company. Then how the system will run without head of the system?

Decentralized DeFi system is run on the voting mechanism where stake holders are vested with the power to vote and decisions are taken as per voting by majority in the system. Such voting mechanism is built with in the system and system is controlled by the such voting mechanism.

Total valuation of the entire DeFi developments till date has been valued up to approx. USD 60 billion which is very small at present in compare to the traditional finance system. In India, one bank like HDFC is valued at approx. USD 160 billion. But there is exponential growth in DeFi in the world which is going to explode in the near future.

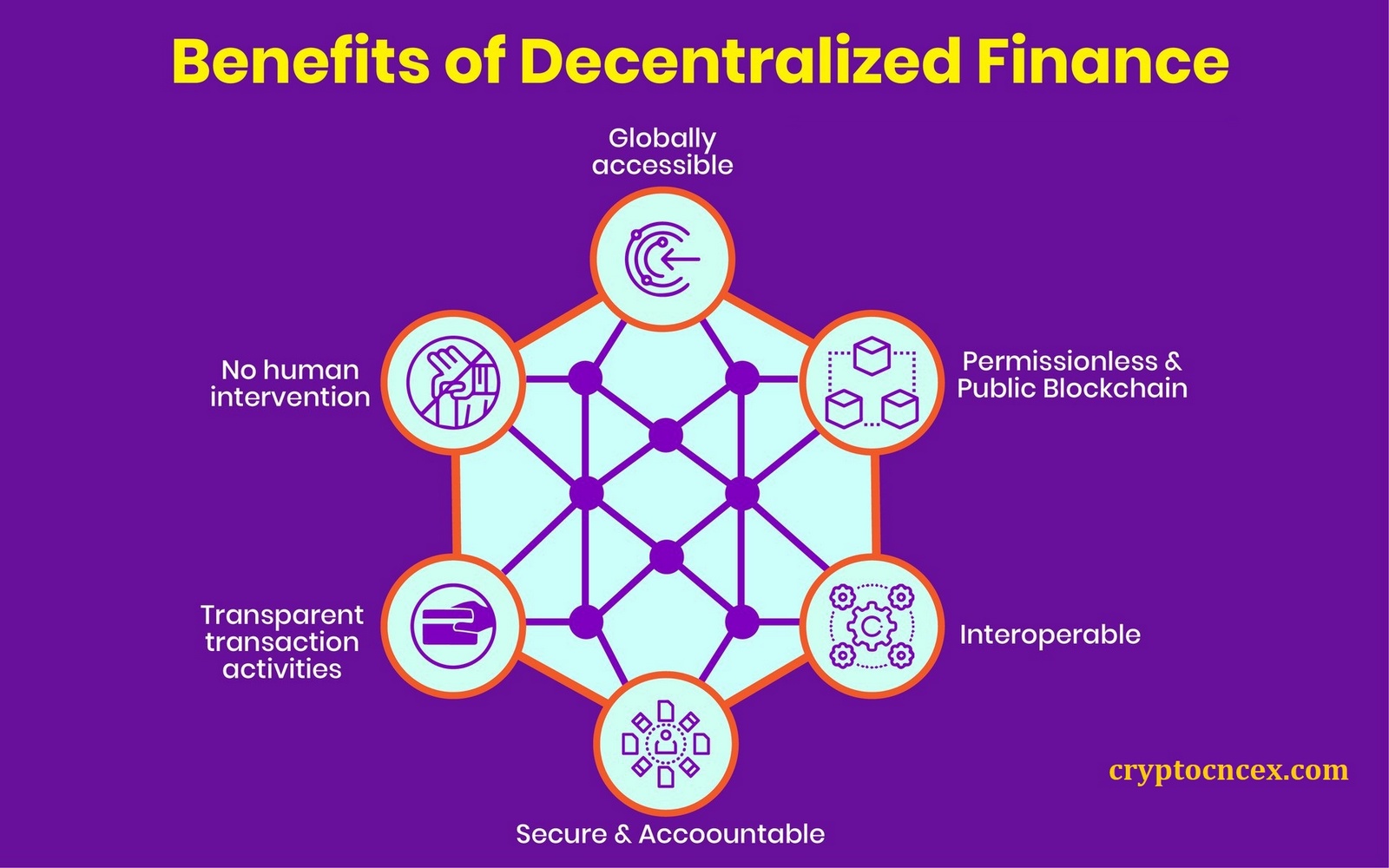

Benifits of Decentralized Finance :

- Globally accessible : Mostly Defi dApps are globally accessible by the public at large and anyone with crypto wallet can transact at Defis with required cryptocurrency in their crypto wallets.

- No human intervention : Defis are decentralized which causes no intermediary and human intervention in the business transactions. Business rules are automated and written in smart contracts i.e. particular type of coding and these smart contracts are self executing.

- Permissionless & public blockchain : Normally Defis are built on permissionless & public blockchains. No central authority is there.

- Interoperable : Now a days Defis are being built in such a way that they can interact among other Defi platforms to smoothen the conduct of transactions with ease, and it makes Defis interoperable. Defi movement is not possible without interoperability. Proper interoperability bridges provide decentralization for users and systems. When these interoperability solutions are adopted, people who currently lack access to financial instruments as basic as a bank account will find it easier to take back control of their own financials and achieve sovereign ownership in a decentralized, trustless, and censorship-free way.

- Secure & accountable : Due to immutability of blockchain, Defis running on such blockchains are secure in nature to operate.

- Transparent transaction : Being acquiring basic quality of blockchain i.e. transparency, Defis provide transparency of transactions to its users publicly.

Risks of DeFis :

DeFi is very interesting available alternate to centralized finance system.

Of course DeFi is very interesting movement/technology development over centralized finance but huge risks are also involved with DeFis.

Some of the risks are to DeFis and some are in to the traditional finance system.

Big four risks in DeFis are :

Technology Risk : As I said earlier that DeFi is technology. Applications of DeFi are usually written in computer codes which are sometimes independent codes or written on other platforms using the open sourced codes available on open source platforms which are used by everyone . In such a case, such programs written in coded language are at the risk of hacking, bugs, different types of errors, etc. This is also true that technology of any type is at such risks of hacking, bugs etc. like in traditional finance is net banking, online transfers, e-commerce payments, etc. Anybody can steal your money in illegitimate manner either from centralized finance or DeFis. But DeFi is new ecosystem of finance world, thats why DeFi is at high risk because of it’ under development stage.

Collateral Risk : One risk was the technology risk of the technology of DeFi with in itself, another risk is with the crypto assets running at the DeFi system. Risk with such crypto assets may be in regard to their technology like technology of USDT, technology of any native token of the DeFi, technology of other crypto assets lying in the wallets at such DeFis, etc. OR it can be valuation risks of such mentioned underlying crypto assets like there may be down or upside movement in the market value or value pegged to such assets like stable coins, etc. Possibilities are there that contractual obligations may be denied by the participating parties at the time of maturity due to such mentioned risks. Good examples are derivatives/margin contracts which need performance at the time of maturity, but market players may abandon the contract rather than fulfilling it due to heavy fluctuations in the valuation of underlying assets.Such risks are called as collateral risks.

Product Risk : More than 100 types of products are there as on today in DeFis. Majority of the DeFi products are transacted on the basis of their price predictions which is something related to price prediction of bitcoin after one month or share prices in stock market, etc. In DeFis, problem in regard to prediction is much more because crypto assets are priced differently at different crypto exchanges which are not connected to any single uniform price mechanism which means price at one exchange can be different from the price at another exchange. Such product risks are actually the oracle problems, which means prices are being derived from the data sourced from external sources. Non-orcale problems also can be there like flaw in the logic of the program written for the underlying asset.Such risks are the product risks.

Regulatory Risk : It’s related to the regulating the conduct of someone/something or DeFi or traditional finance world. In traditional finance, there is regulation of getting license for operating a bank/non-bank finance entity, etc. In DeFis, as on today there is no such regulation of getting license to operate crypto bank under DeFi. Certain countries have different types of mechanism in place for regulation of DeFis but such are voluntary. It may be possible that today you start operating any financial entity under DeFi without license from the regulator and after sometime regulator comes in and ask you why you are operating business of financial transactions when I have not licensed you to do this. Similar type of situation arose with Ripple’s XRP in USA by SEC, the financial watchdog of USA. I know one crypto bank ‘CASAA’ which has taken licenses from various regulators in UK/Europe, etc.

Crux of the story is that we should be aware about various types of risks involved in DeFis and their products.

Applications/Uses of Defis

A. LENDING PROTOCOLS :

STAKING, YIELD FARMING and LENDING: Normally people try to earn some additional income in form of interest/dividend/appreciation in value etc. by putting/investing some of their money as principal amount.

The terms Staking/Yield Farming/Lending evolved very strongly in the blockchain & crypto space since the adoption of cryptocurrencies and blockchain technology.

STAKING is usually offered by the creators of the coin like Cardano offers to stake in ADA. Creator of the token offer you to stake its token and in exchange you are offered good amount of return (in form of same staked token) may be in form of percentage (10 to 25%) or some fixed sum. In staking, fixed amount of tokens are locked for some fixed time period while using the smart contracts, to strengthen the network and authenticate the transactions. It may be an individual stake or in a pool where small investors are clubbed together to contribute in the pool which further stakes the token and assured return is given to the pool and then distributed to the pool members in the proportion of their staked amount.

Certain amount of tokens are locked and such supply is sucked from the market which means less supply and more demand which works as catalyst to price increase in the value of token.

In a pool, more number of people with less volume of transactions means lesser returns and less number of people with more volume of transactions means better returns. High volume means more fees get collected and distributed in a pool as high average per member of pool in case less numbers & low average in case high numbers of pool members.

One more interesting way of earning from Yield farming (similar to staking) is like in a pool of certain say 6 coins, you farm any one coin but you will get profitability from the plus minus movements in any or all 6 coins. It’s termed as pool farming.

Liquidity mining : this term is in context with DeX (decentralized exchange) where tokens are traded(buying & selling) against a liquidity pool where people like you or me put coins. Buyers come to buy and sellers come to sell at the pool. Theoretically you are buying from the DeX and selling to DeX but remember that DeX is not owning those coins which are put in by the people who are providing the liquidity in the pool.

Why people put their tokens in pool at DeX? It’s for profitability as share from the fees charged by the DeX for doing transactions of buying/selling at DeX. DeX distributes some fixed sum of money from the fees charged by it to the people who provide liquidity to the DeX.

In case of liquidity mining, sometimes traded volume becomes very high but people providing liquidity are less which again works as more returns for liquidator because more fees gets collected from the high traded volume which provides more share to liquidators which are already less in the pool.

Lending : It relates itself to margin trading or leveraged trading where you can do a trade of Rs.1000 by investing Rs.100. It is 10 times of investment. So, you have leveraged your trade to the extent of 10 folds of your investment. OR you can lend your stock to provide liquidity for others who want to avail this facility of leveraged trading.

Risks involved in Staking : when you stake, coins will stay in a smart contract which may be vulnerable to hacking due to which you may lose your entire or part amount of coins.

Yield farming : Here, you may get offer of very catchy/high rates of interest like 60% or 90% etc. which is fishy because such huge return is suspicious and chance of losing principal is high.

B. ASSETS TOKENIZATION :

TOKENIZATION : It’s an important term liked by majority of the people in crypto world.

Let’s discuss what does it mean?

I would prefer to combine ‘Tokenization’ with another term ‘Digitization’.

Digitization : Let’s go in to past when most of the financial transactions used to be on a piece of paper. Ex- share certificates used to be on a paper like security paper if you remember or have seen, Fixed deposits receipts (FDR) used to be issued on a piece of paper, Pass book on a paper like a booklet which is still in use. But during 1990s onwards in India, with computers came and internet introduced, digitization of financial documents was started with slow speed. Shares certificates were digitized and D-MAT accounts were introduced where shares with their distinctive serial numbers were issued digitally. FDRs were digitized. Passbooks also were digitized like bank statement in soft copy (i.e. e-statement).

How Digitization is different from Tokenization :

Digitization is a ‘Dumb’ act which means conversion of paper data in to digital format without involving any element of intelligence.

Tokenization has vast meaning but here at least is taking digital assets like pictures, documents, pdfs or various other formats like movies etc. and adding some intelligence to such digital assets. Here intelligence is to fractionize such digital assets in to parts. Ex- Reliance share of Rs. 2000 per share fractioned in to parts (Tokenized) and now we can buy 100th part of this digital format of Reliance share @Rs. 20 also after it’s tokenization.

Tokenization is one step beyond digitization.

Three important aspects of tokenization are ‘Storage’, ‘Transmission’ & ‘Smart Contracts’.

In crypto world, way of Transmitting Tokens from one party to another is direct which means without involving 3rd party or middleman or service provider like in digital world we transfer money from one party to another through a bank as middleman but in crypto world, there is no need of middlemen to transmit crypto money (I mean tokens here). I can transfer tokenized image directly to you. This is also called peer-to-peer transmission.

Another aspect is Storage. We can store tokenized digital assets in to crypto wallets from where we can transfer tokenized crypto assets to another crypto wallet. We can also receive tokenized assets in our crypto wallets from other crypto wallets.

Smart contracts here means embedding self executing instructions in to the tokenized digital asset. In case of every sale of tokenized image, if instructions of royalty to be paid to the creator/owner at some fixed % of sale price or whatever are already there through smart contract, then automatically royalty will be transferred to the concerned owner/creator with every sale of tokenized image.

Future of Tokenization : Everything that can be tokenized will be tokenized. Like today in digital world, everything in digital form is with in the reach of a common man even a poor man also can have access to such digital things. Same way will happen with ‘everything that can be tokenized will be tokenized’. Revolution in Telephones from Landlines to mobiles is great example to predict the future of tokenization.

NFTs – (Non – Fungible Assets)

Assets which can substitute one with other without any erosion in value are fungible in nature.

Non fungible assets means two different assets with their different identities or values.

Fungible: Ex- Two Rs.100 notes are there for you to choose any one, you choose any note of these two because both the notes have same value. There may be five notes of Rs.100 and one note of Rs.500, you are asked to choose either five notes of Rs.100 or one note of Rs.500. You may choose any one because both the situations have same value for you. This is the situation of ‘Fungible assets’

Non-Fungible: Ex- Two similar assets are there and you care about to choose which one of these two. Reasons of your such care may be like – different underlying values of these two assets or may be some emotional attachment you have or may be some speculative reason of future or any other reason. Not only two assets but there can be more than two assets for you to make choice. Like you go for shopping for shirts, you choose one or two out of so many shirts due to different reasons like colour, style or quality or brand etc.

Very good example of non-fungible just came to my thought is ‘PARENTS’. Parents are non-fungible. For you or me, Parents can not be the substitute of any other parents.

What is more there in this world – fungible or non-fungible? Quite obvious non-fungible assets are more than fungible in the world. Almost everything is non-fungible in this world.

Non-Fungible Tokens (NFTs):

In case of non-fungible assets, when there is ownership in such assets and such ownership is tokenized, then such tokenization of non-fungible assets is known as NFTs – Non-fungible tokens.

Ex- You bought a car which is non-fungible asset for you due to different reasons. Now, you tokenized the ownership in such car and sold it which means you transferred the ownership of that car to someone else. Or another case if say there is a digital image ownership of which has been tokenized and you bought ownership in that image and paid the amount in tokens, that ownership itself becomes non-fungible token.

NFT is the tokenized representation of non-fungible asset.

The most important aspect of NFTs is their value. How NFTs accrues value?

Simply speaking value comes from demand. Price of a NFT is derived from it’s demand. But, how such demand arises and from where it comes – it’s very important aspect. Specially for investors, it’s important to know about such phenomenon of demand and supply of NFTs.

Value or price of a NFT is derived from the underlying ownership right in the asset. Right to own a NFT is different from right to view NFT. Ex- Popular NFT of an image has a right of ownership in it due to various reasons like who made it/designed it/material used to make it/whose picture or what message in the image. The owner of this image (NFT) may decide to sell at higher price in future which is the speculative reason of deriving demand & value of such NFT or there may be emotional reason for a person to buy/hold/sell such an image (NFT).

Are NFTs a Fad?

Fad means any activity getting popular without any logic. This is the early stage of NFTs, so it’s my assumption that most of the NFTs are Fad and getting popular without any logic. NFTs are very interesting in themselves but with logical use case like in real estate, some games like crypto kitties, for singers, for painters/artists, for sports persons etc.

Future of NFTs : NFTs have great future ahead. Everything that can be tokenized will be tokenized.

C. Crypto Exchanges : Decentralized Exchanges (DeX) :

DeX is purely built on blockchain technology and works without centralized authority. Private key is in your hands. DeX is privacy focused exchange and secured from hacking attacks but to the extent of size of the blockchain like how many participants are there, safety measures implant in the blockchain. You can create your own wallet with your private key at the DeX. If you loose private key, then your cryto assets are lost. DeX are facing the problems of slow transactions speed, scalability, high volatility in the crypto assets. Such problems are now being tacked with the help of latest technology in blockchain by using interoperability of blockchains, cross chain applications like adopting cross chain bridges, solving problem of liquidity among blockchains (like pNetwork). DeX is the new thing for the crypto traders around the world and they are not much used to with DeX. Example of famous DeX : Binance DeX. Indian exchange WazirX is also going to launch its DeX may be in August of 2021.

DeX is also normally built with ‘No KYC/AML’ feature but over a period of time this feature is being replaced with ‘KYC/AML basic documents required’ like passport or driving license etc.

D. Crypto Derivatives Trading : Bitcoin Futures Trading (Bitcoin ETFs) :

Defi is also used as an exchange for crypto derivatives trading like Bitcoin Futures. We are talking about bitcoin ETF here which means investors of cryptos can invest in bitcoin indirectly through ETF(Exchange Traded Funds) without actually owning bitcoin and without worrying about storage of bitcoin.

ETFs in traditional sense mean an investment vehicle for those who want to diversify their portfolio of assets. Investor can invest in different asset classes indirectly through ETFs without actually owning such asset class.

Same way, recently first Bitcoin ETF has been approved by SEC in USA and more are in pipeline for approval.

Responsibility of storage of bitcoin is with company running ETF. Institutional investors can trade or invest through ETFs.

E. KYC / AML :

Blockchain based Defi solutions can be used to check and authenticate transaction details to curb frauds and scams.

F. Creating Stablecoins :

Stablecoins are cryptos which are pegged to asset in physical world with fixed value. Example is USD as pegged fiat currency and USDT as stablecoin digital/cryptocurrency. USDT is pegged to USD either in form fiat currency or commercial papers with value equivalent to USD. Lot of various stablecoins are in circulation in crypto world. Process of creating stablecoin comes under Defi application.

#wazirxwarriors #cryptocncex #bitcoin #cryptocurrency #investment #definews #blockchain #digital #finance #indiawantscrypto #payments #banking

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  Litecoin

Litecoin  Polkadot

Polkadot  Ethereum Classic

Ethereum Classic  PancakeSwap

PancakeSwap  GALA

GALA  Decentraland

Decentraland  Polygon

Polygon  IoTeX

IoTeX  BUSD

BUSD